Seamlessly integrate your bank accounts into Business Central with Direct Banking.

Direct Banking is available from €22.50 / £20.00 / $25.00 per month.

The powerful benefits of Direct Banking

- Support for major banks: access all major banks across the EU and worldwide.

- Automated reconciliation: bank statements sync directly with Business Central, while our software handles automatic reconciliation.

- Time savings: reduce processing time for bank statements by 80%.

- Direct payments: send payments straight from Business Central to your bank.

Seamless banking connectivity!

Cobase integrates over 15,000 international banks ; almost 2,000 EU Banks are connected through Ponto.

No more manual work!

With Direct Banking, no more manual file uploads or manual data entry of your bank statement lines! Everything synchronizes automatically with your bank accounts and journals in Business Central.

With Direct Banking no more bank files are needed. Everything is synchronized automatically with your banks.

Ponto or Cobase?

Choose Ponto if you have an EU bank and primarily handle EU payments (SEPA). Opt for Cobase if you work

with non-EU banks, handle a high volume of international payments, or manage many multiple bank accounts.

Ponto offers an accessible and affordable solution. Set up a Ponto account online, add your bank accounts, and you’re ready to implement Direct Banking quickly and easily.

Ponto: https://myponto.com/

Ponto EU bank availability: https://myponto.com/en/reach/open-banking-api-europe/

Cobase connects to banks around the world, providing a state-of-the-art payment portal. Make payments from Business Central with the Direct Banking App for Cobase. The portal also supports payment authorization — no bank credentials required.

Cobase: www.cobase.com

Elevating 3,500 Businesses Worldwide through Smart Apps

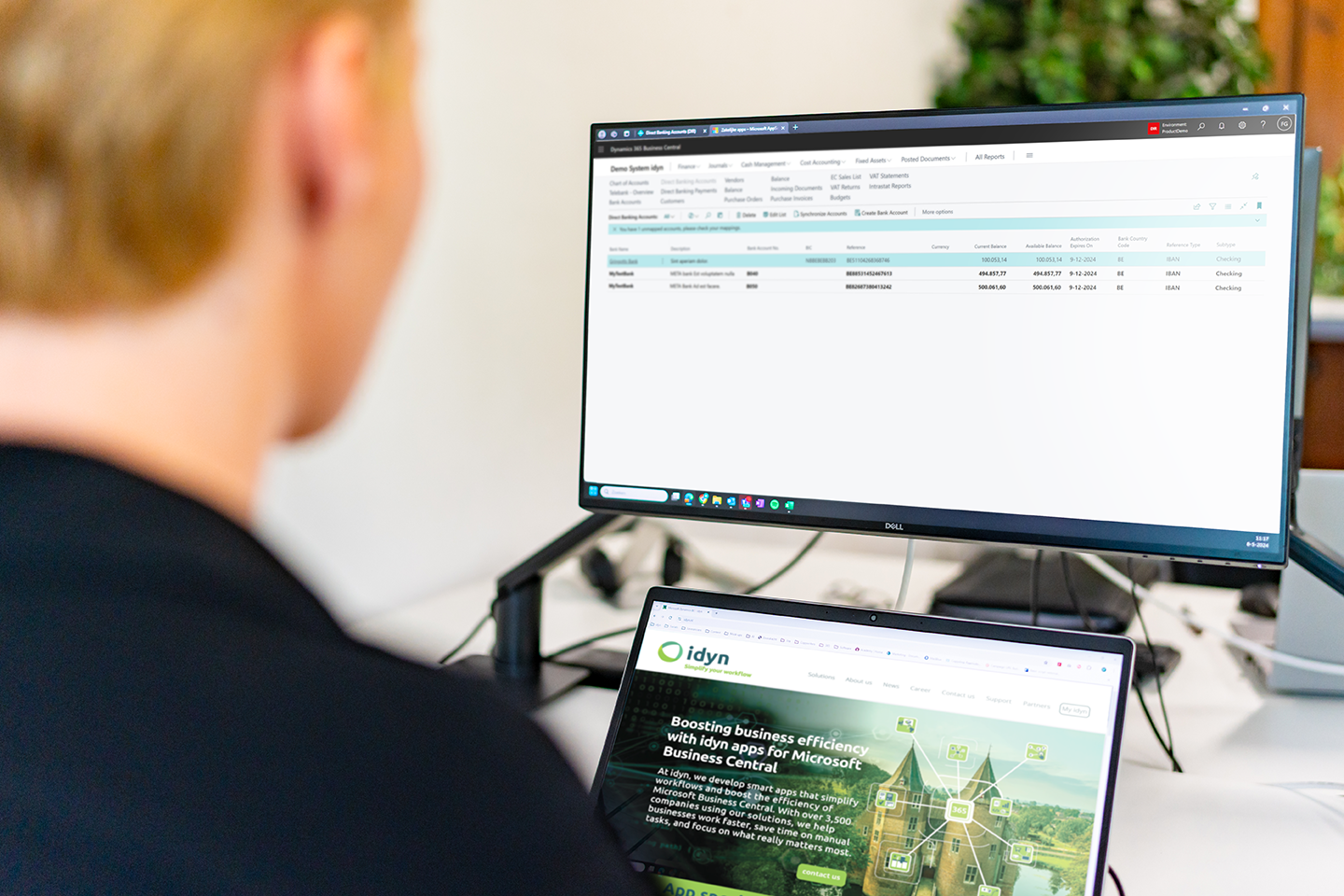

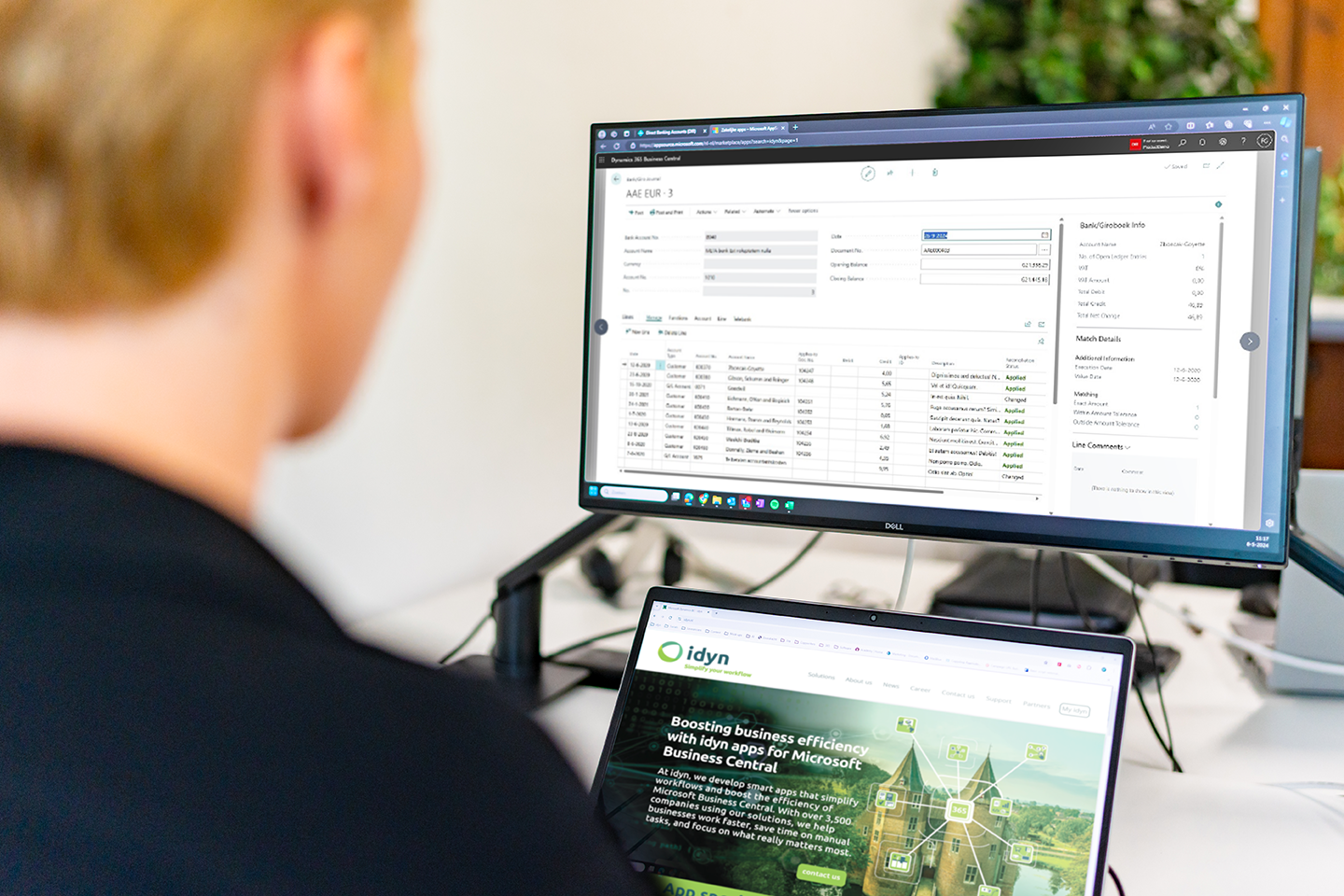

Overview of your managed bank accounts with Direct Banking.

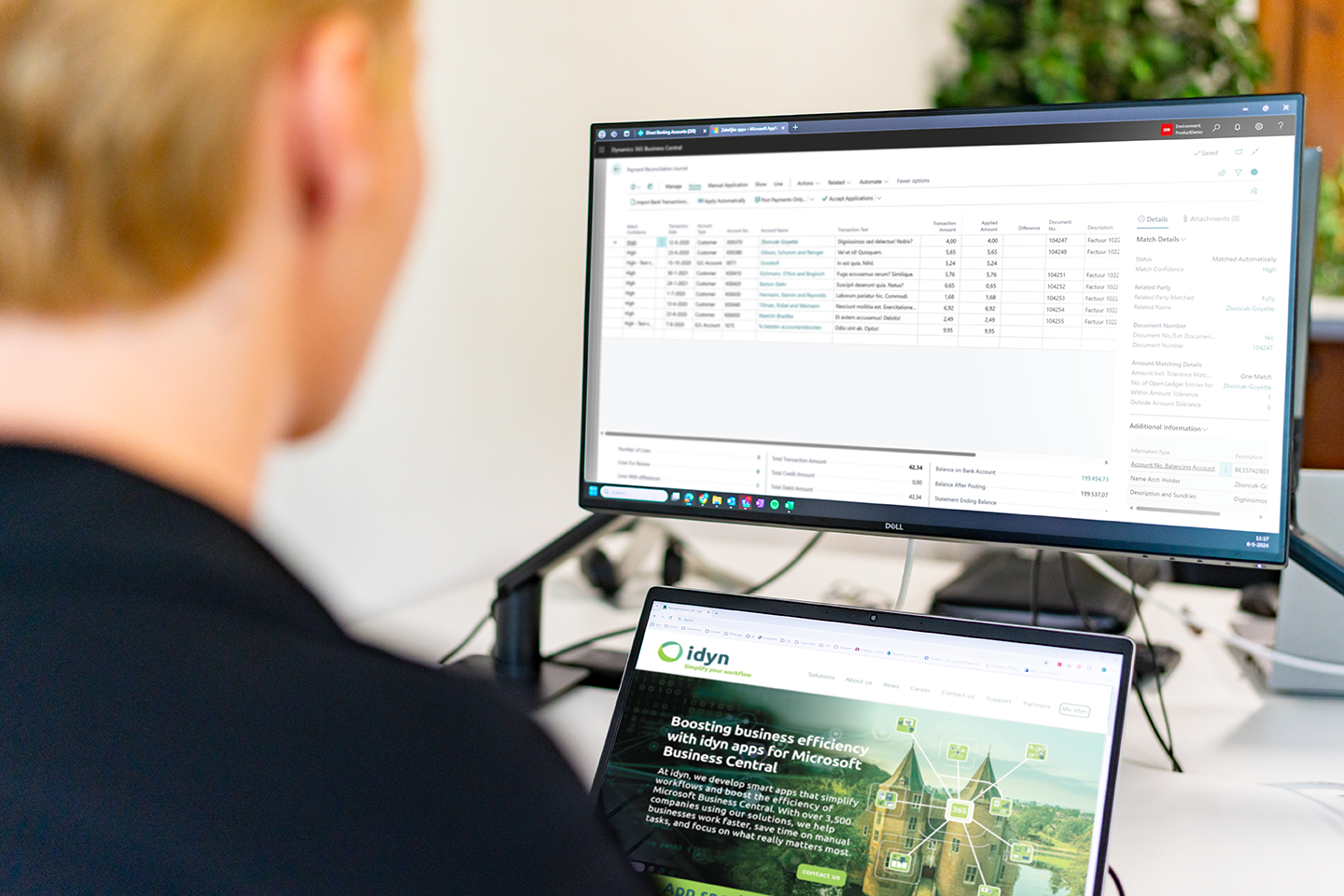

Automatic reconciliation by Direct Banking in the journal.